For eCommerce businesses, having a reliable and secure payment processing system is essential. Shopify Payments, Shopify’s built-in payment gateway, simplifies the transaction process by eliminating the need for third-party payment processors like PayPal or Stripe. This native payment solution helps merchants reduce costs, speed up transactions, and streamline financial management directly within their Shopify store.

This guide provides a detailed overview of Shopify Payments, including its features, benefits, transaction fees, supported payment methods, setup process, and available alternatives.

I. What Is Shopify Payments?

Shopify Payments is Shopify’s integrated payment gateway that allows merchants to accept payments directly on their online store without needing to connect an external provider. This solution eliminates additional transaction fees that Shopify charges when using third-party gateways, making it a cost-effective and convenient option for business owners.

Unlike external gateways, Shopify Payments is fully embedded into the Shopify ecosystem, meaning all transaction data, chargebacks, and payouts are managed directly within the Shopify admin dashboard. This integration allows for a seamless user experience, helping businesses maintain a smooth checkout process without redirecting customers to external platforms.

1.1. Key Features of Shopify Payments

- No Additional Transaction Fees: When using Shopify Payments as the primary processor, merchants avoid extra fees that Shopify imposes on third-party gateways.

- Fast Payouts: Funds from transactions are deposited into the merchant’s bank account within two to three business days, depending on the country.

- Seamless Shopify Integration: Shopify Payments is fully embedded within the Shopify platform, enabling merchants to manage transactions, refunds, and chargebacks from the Shopify admin panel.

- Support for Multiple Payment Methods: Shopify Payments supports credit and debit cards, digital wallets like Apple Pay and Google Pay, and Buy Now, Pay Later (BNPL) options like Klarna and Affirm.

- Multi-Currency Support: Businesses can accept payments in multiple currencies, allowing international customers to pay in their local currency.

- Fraud Prevention and Security: Shopify Payments includes built-in fraud detection and analysis tools to help merchants identify and prevent suspicious transactions.

- Automatic Chargeback Handling: For Shopify Plus merchants, Shopify Payments provides automatic chargeback responses and protection.

1.2. Pros and Cons of Shopify Payments

II. Who Can Use Shopify Payments?

2.1. Supported Countries

As of 2025, Shopify Payments is available in several countries, including:

- United States

- Canada

- United Kingdom

- Australia

- New Zealand

- Germany

- France

- Spain

- Italy

- Netherlands

- Sweden

- Denmark

- Japan

- Hong Kong

- Singapore

Merchants outside these countries must use a third-party payment gateway, such as PayPal or Stripe, to process transactions.

2.2. Restricted Businesses

Shopify Payments does not support businesses that operate in certain high-risk industries. Merchants selling the following products or services are prohibited from using Shopify Payments:

- CBD and cannabis-related products

- Firearms, ammunition, and weapons

- Gambling, betting, and gaming services

- Cryptocurrency exchanges and wallets

- Adult content and services

Businesses in these industries must use external payment providers that cater to high-risk merchants.

III. How Does Shopify Payments Work?

Shopify Payments processes transactions directly on a merchant’s Shopify store, eliminating the need for redirection to third-party platforms. The process works as follows:

- Customer Checkout: The shopper selects products and proceeds to checkout.

- Payment Authorization: Shopify Payments verifies the payment details and checks for fraud.

- Transaction Processing: Once approved, the payment is processed, and the order is confirmed.

- Funds Settlement: The transaction amount, minus processing fees, is credited to the merchant’s Shopify Payments balance.

- Payout to Merchant: Shopify transfers the earnings to the merchant’s bank account within two to three business days.

This streamlined process ensures quick and secure transactions while improving the checkout experience for customers.

IV. Which Payment Methods Does Shopify Payments Include?

Shopify Payments supports a wide range of payment methods, enhancing flexibility for both merchants and customers.

4.1. Accepted Payment Methods

- Credit and Debit Cards: Visa, Mastercard, American Express, Discover

- Digital Wallets: Apple Pay, Google Pay, Shop Pay

- Buy Now, Pay Later (BNPL): Klarna, Affirm, Afterpay

- Local Payment Methods: iDEAL (Netherlands), Bancontact (Belgium), SEPA Direct Debit (Europe)

By offering multiple payment options, merchants can improve conversion rates and reduce cart abandonment.

4.2. Shopify Payments Fees

Shopify Payments charges processing fees based on the merchant’s Shopify plan.

If a merchant uses an external payment provider instead of Shopify Payments, Shopify charges additional transaction fees:

- Basic Shopify: 2% per transaction

- Shopify: 1% per transaction

- Advanced Shopify: 0.5% per transaction

To avoid these extra fees, merchants should use Shopify Payments as their primary processor.

V. How to Get Started with Shopify Payments?

Setting up Shopify Payments is a straightforward process that can be completed within a few minutes. By following these step-by-step instructions, you can quickly activate Shopify’s built-in payment gateway and start processing transactions on your online store.

Setting up Shopify Payments in 2025 remains a straightforward process, enabling merchants to seamlessly accept payments directly through their Shopify stores. Here's a step-by-step guide to help you get started:

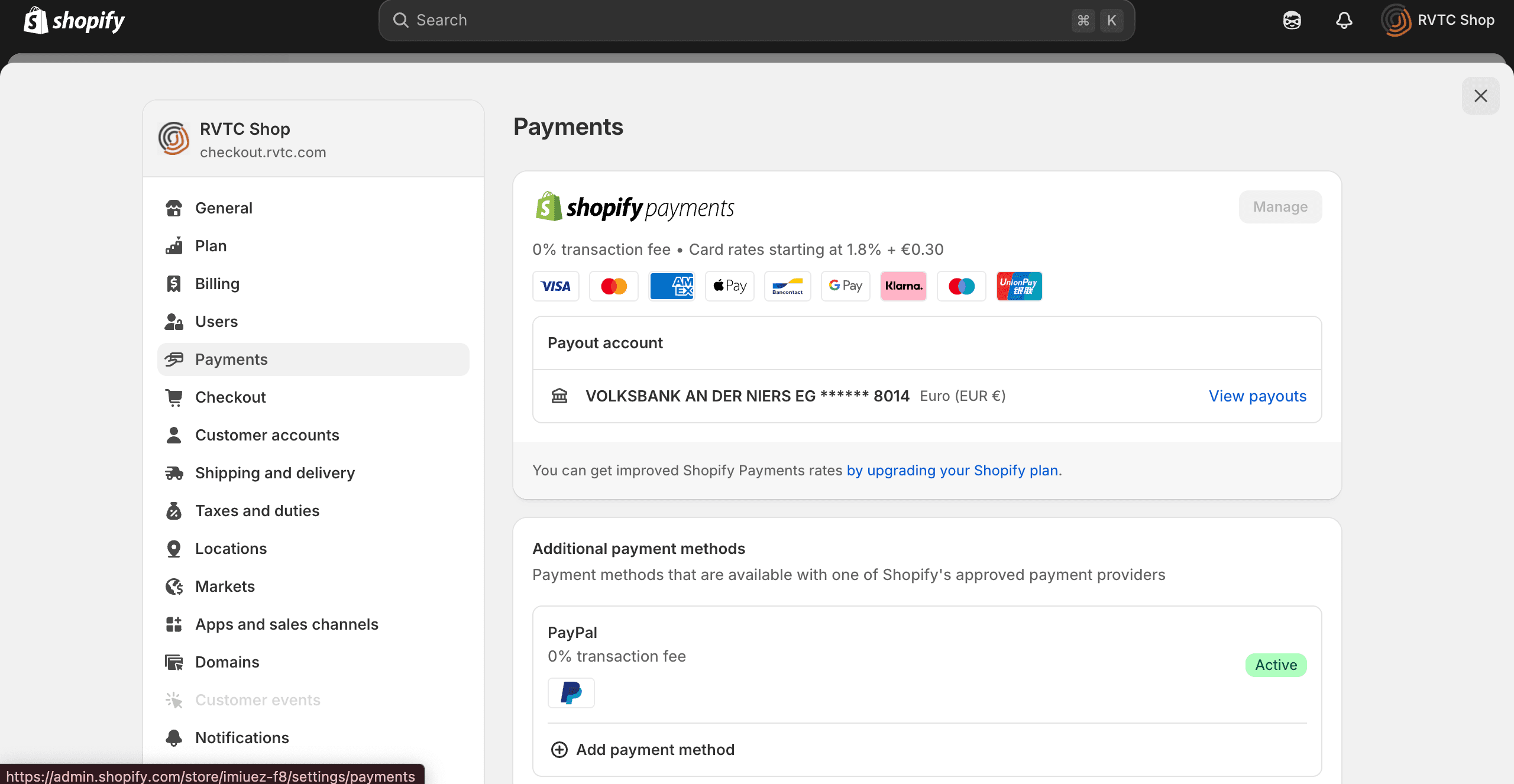

Step 1: Access Your Shopify Admin Panel

Log in to your Shopify account to access the admin dashboard, where you can manage all aspects of your store.

Step 2: Navigate to Payment Settings

-

Click on Settings in the bottom-left corner of the dashboard.

-

Select Payments from the available options.

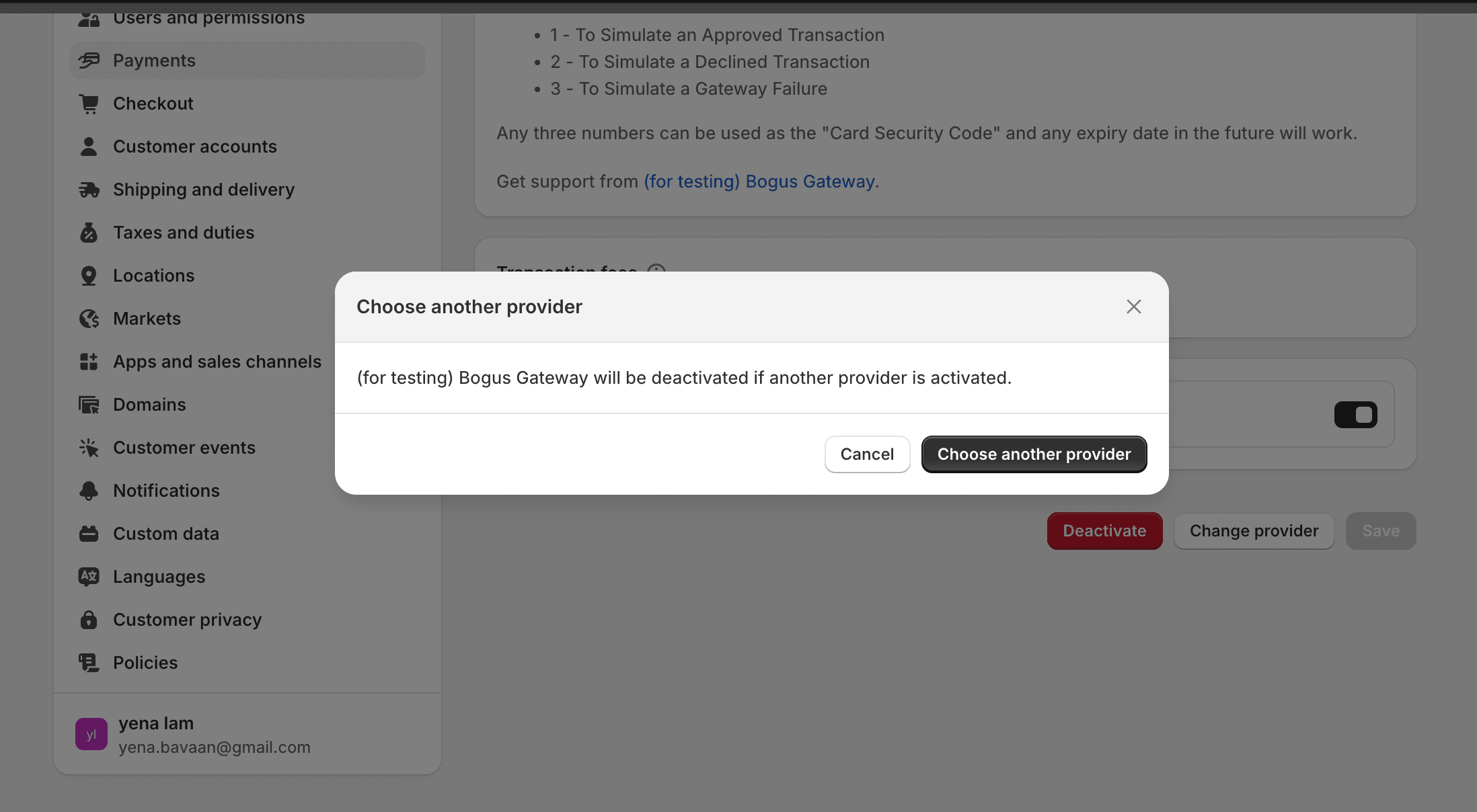

Step 3: Activate Shopify Payments

If Shopify Payments is available in your region, it will appear as an option.

- Click Activate Shopify Payments.

- If you've previously set up a different payment provider, you'll have the option to switch to Shopify Payments.

Step 4: Complete Account Setup

Provide the necessary details to set up your account:

- Business Information: Enter your business type, address, and relevant identification numbers.

- Personal Details: Provide information about the account holder, including name, date of birth, and job title.

- Product Details: Describe the products or services you offer.

- Customer Billing Statement: Specify how your business name will appear on customer billing statements and provide a contact phone number.

Ensure all information is accurate to avoid delays in account activation.

Step 5: Set Up Two-Factor Authentication (2FA)

To enhance account security, Shopify requires enabling two-factor authentication:

- Choose an authentication method, such as SMS or an authenticator app.

- Follow the on-screen instructions to complete the setup.

Step 6: Enter Banking Information

Provide your bank account details to receive payouts:

- Enter your bank account number and routing number (or the equivalent for your country).

- Double-check the information for accuracy.

- Click Save to finalize the setup.

Step 7: Configure Additional Settings (Optional)

After activation, you can customize further settings:

- Fraud Prevention: Enable options like CVV and AVS checks to automatically decline suspicious charges.

- Payout Schedule: Decide how frequently you'd like to receive payouts (daily, weekly, or monthly).

By following these steps, you can efficiently set up Shopify Payments, providing a seamless and secure payment experience for your customers.

Explore here: How To Setup Shopify Payments (2025)

VI. Alternatives to Shopify Payments

For merchants who cannot use Shopify Payments, third-party payment gateways offer alternative solutions.

Conclusion

Shopify Payments is a powerful and convenient payment solution for Shopify merchants. By eliminating extra transaction fees and providing fast payouts, it simplifies payment processing. However, businesses in unsupported countries or restricted industries must rely on third-party payment providers.

For merchants looking to optimize payment processing, Shopify Payments remains one of the best solutions for seamless and cost-effective transactions.

Read more: