Nowadays, efficient payment processing is crucial for providing a seamless shopping experience. especially in e-commerce niche. Shopify, one of the leading e-commerce platforms, offers various payment gateways to facilitate transactions for its users. Among these, Stripe stands out as a popular choice due to its robust features and ease of integration.

This blog will explore the integration of Shopify and Stripe, highlighting the benefits and providing a guide for setting up Stripe as a payment gateway on your Shopify store.

I. Key notes about Stripe before integrating with Shopify

Stripe is a leading online payment processing platform that allows businesses to accept payments from customers through their website, app, or any other online platform. As a third-party payment solution, it is designed to meet the needs of various e-commerce platforms, providing a simple yet effective way to handle transactions.

Stripe offers a range of tools that help streamline the payment process, reducing complexity and ensuring a smooth transaction experience for both merchants and customers. Known for its user-friendly setup, Stripe enables business owners to create a free online account within minutes, making it one of the best solutions for online businesses.

Stripe's highlight features

Who should use Stripe?

Stripe has become a popular choice for businesses of all sizes and across various industries. Here's a breakdown of some of the major types of companies that utilize Stripe:

-

E-commerce Sites: Ideal for online stores selling products directly to consumers.

-

Retail Online Stores: Perfect for traditional retailers expanding into online sales.

-

B2B Platforms: Efficiently handles transactions between businesses.

-

Software as a Service (SaaS): Manages recurring billing and subscriptions for software products.

-

B2C Marketplaces: Facilitates payments between buyers and sellers.

-

Nonprofits and Fundraisers: Simplifies the process of accepting online donations.

Stripe's pros and cons

How does Stripe work?

Let's see how Stripe works to handle the entire payment process on your Shopify store:

-

Payment Initiation: A customer selects a product and proceeds to checkout.

-

Data Submission: The customer's payment information is securely submitted to Stripe.

-

Transaction Processing: Stripe processes the payment, including fraud checks and authorization.

-

Funds Transfer: Once approved, the funds are transferred to your bank account, typically within a few days.

II. Why integrating Stripe with Shopify is a must-have this year?

In Shopify payments, having a payment processor and a payment gateway is essential for managing online transactions. The Shopify payment gateway stores and transmits the customer’s credit card details to the processor, which then handles the transaction.

The funds from the customer’s bank are temporarily transferred to a merchant account, with credit card fees deducted from the total amount. Finally, the payment is directed to the business account. This process can seem quite complicated, which is why many web development companies recommend integrating Stripe with Shopify to simplify the payment process.

Stripe offers a more straightforward solution by combining gateway functionality with payment processing, providing an efficient way to manage e-commerce transactions. As a payment processing platform, Stripe ensures seamless transfer of money from a customer’s bank account to your business account through credit and debit card transactions. It is referred to as a “full-stack payment processor” because it functions as both a third-party payment processor and a payment gateway.

-

Seamless integration: Easy setup allows for quick start, ensuring reliable and fast transaction processing to reduce the risk of abandoned carts.

-

Reliability and scalability: Stripe’s robust infrastructure can handle millions of transactions seamlessly, support business growth and ensure reliability.

-

Global reach: Accept payments in over 135 currencies and offer various local payment options to cater to a global customer base and increase conversion rates.

-

Flexible payment options: Supports all major credit and debit cards, as well as digital wallets like Apple Pay and Google Pay, providing customers with convenient payment methods.

-

Recurring payments: Easily set up and manage subscription plans for products or services, automating recurring billing.

-

Enhanced security: Ensures PCI DSS Level 1 compliance and uses advanced fraud detection tools like Stripe Radar to protect your store from fraudulent transactions.

-

Developer-friendly integration: Access comprehensive APIs and webhooks for custom integrations and create a tailored checkout experience that aligns with your brand.

-

Advanced reporting and analytics: Provides comprehensive reports and real-time transaction data for insights into sales, customer behavior, and trends.

-

Improved customer experience: Streamlined checkout process reduces friction, increases conversion rates, and is optimized for mobile devices to enhance customer satisfaction.

-

Cost-effective: Offers transparent and competitive pricing with no setup fees, making cost management easier.

III. Step-by-step guide to integrate Stripe to your Shopify

Without further ado, let's go through the detailed guidelines to add Stripe to your Shopify store seamlessly.

Step 1: Create a Stripe account

If you don't already have a Stripe account, you'll need to create one.

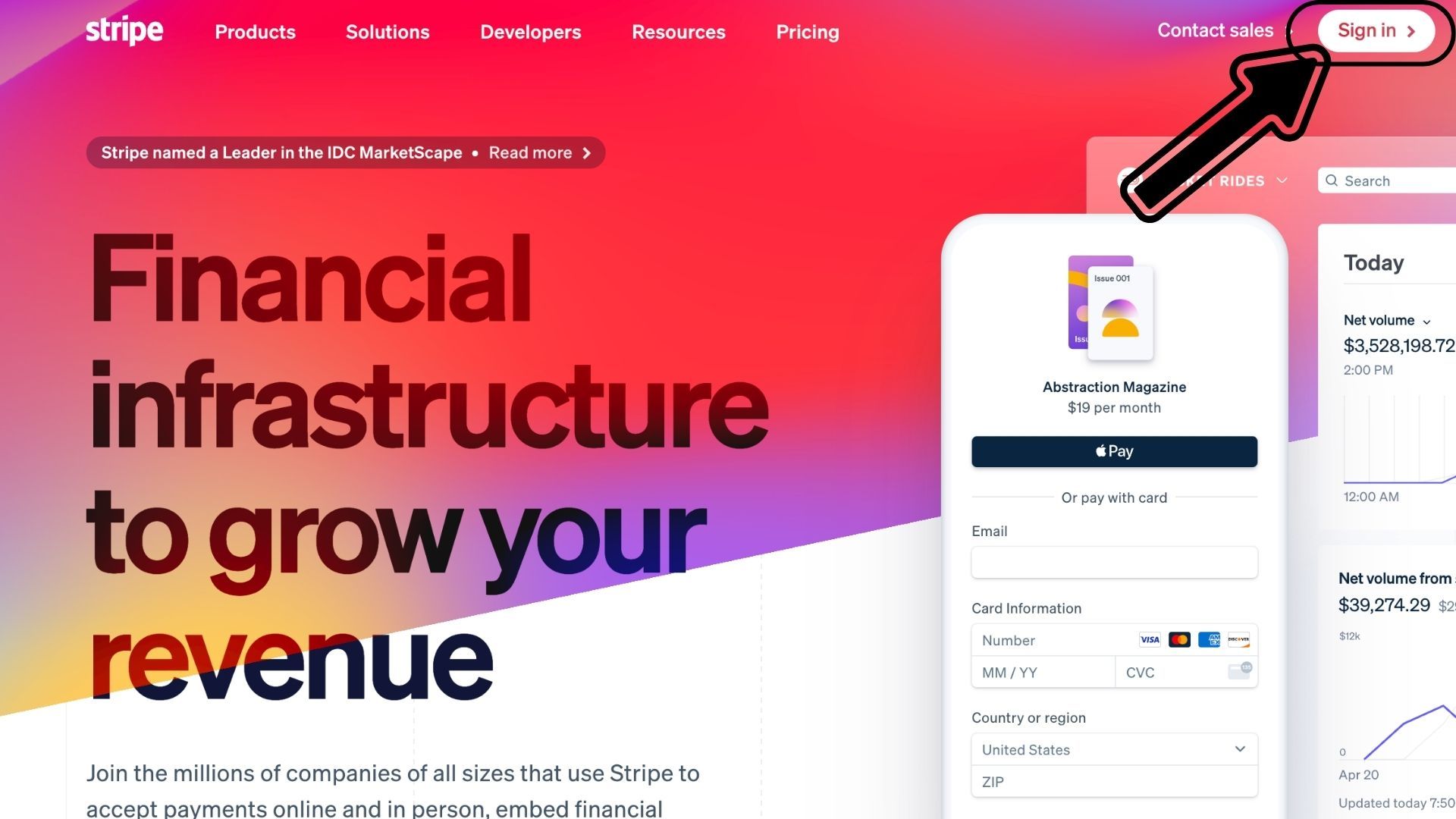

1. First, Visit the Stripe website

2. Then, Click on the “Sign Up” button on the Stripe homepage and click on it to initiate the account creation process.

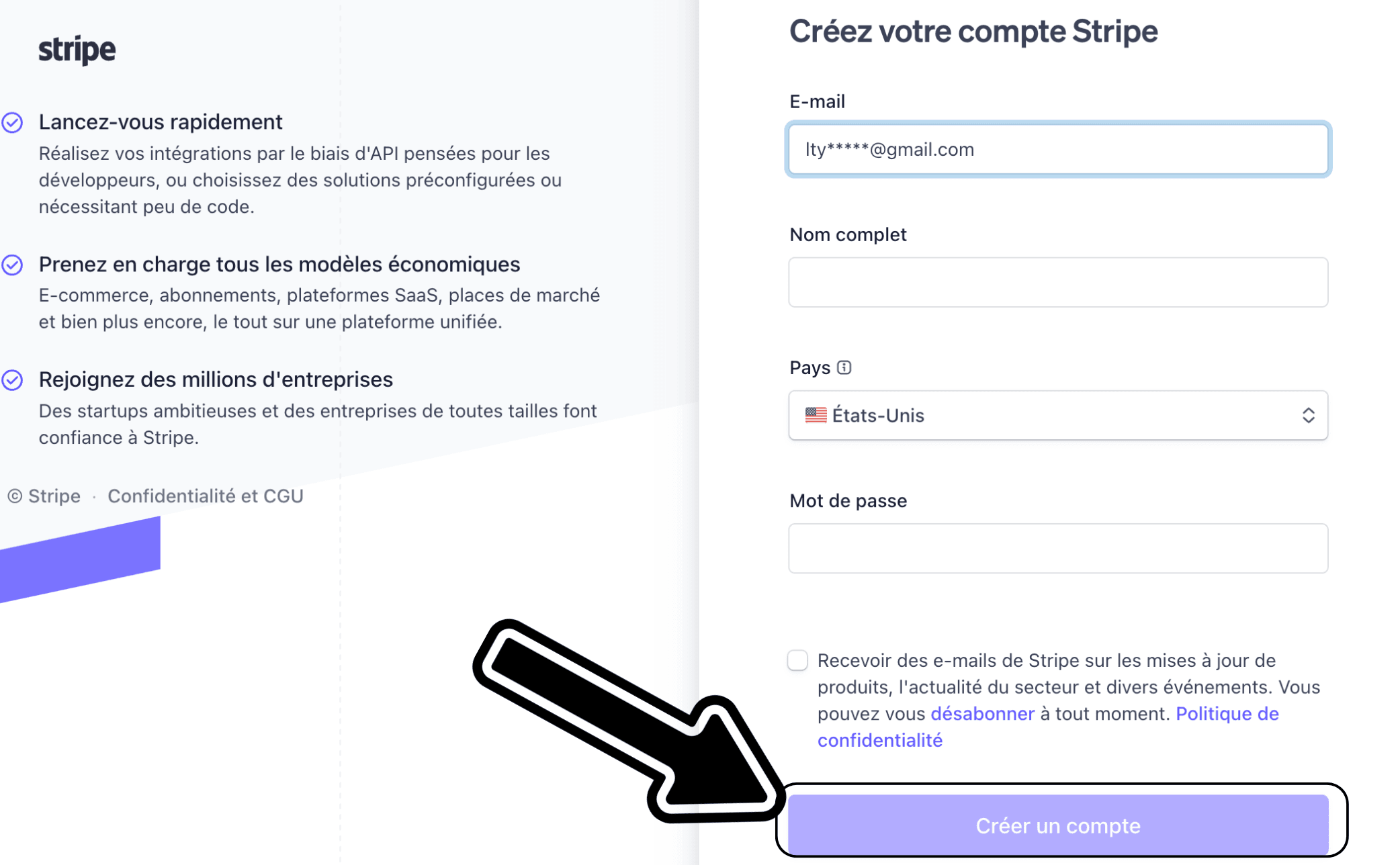

3. Now, Stipe requests business details. Fill out your email, full name, country, and password.

4. When you finish, click the blue “Create account” button.

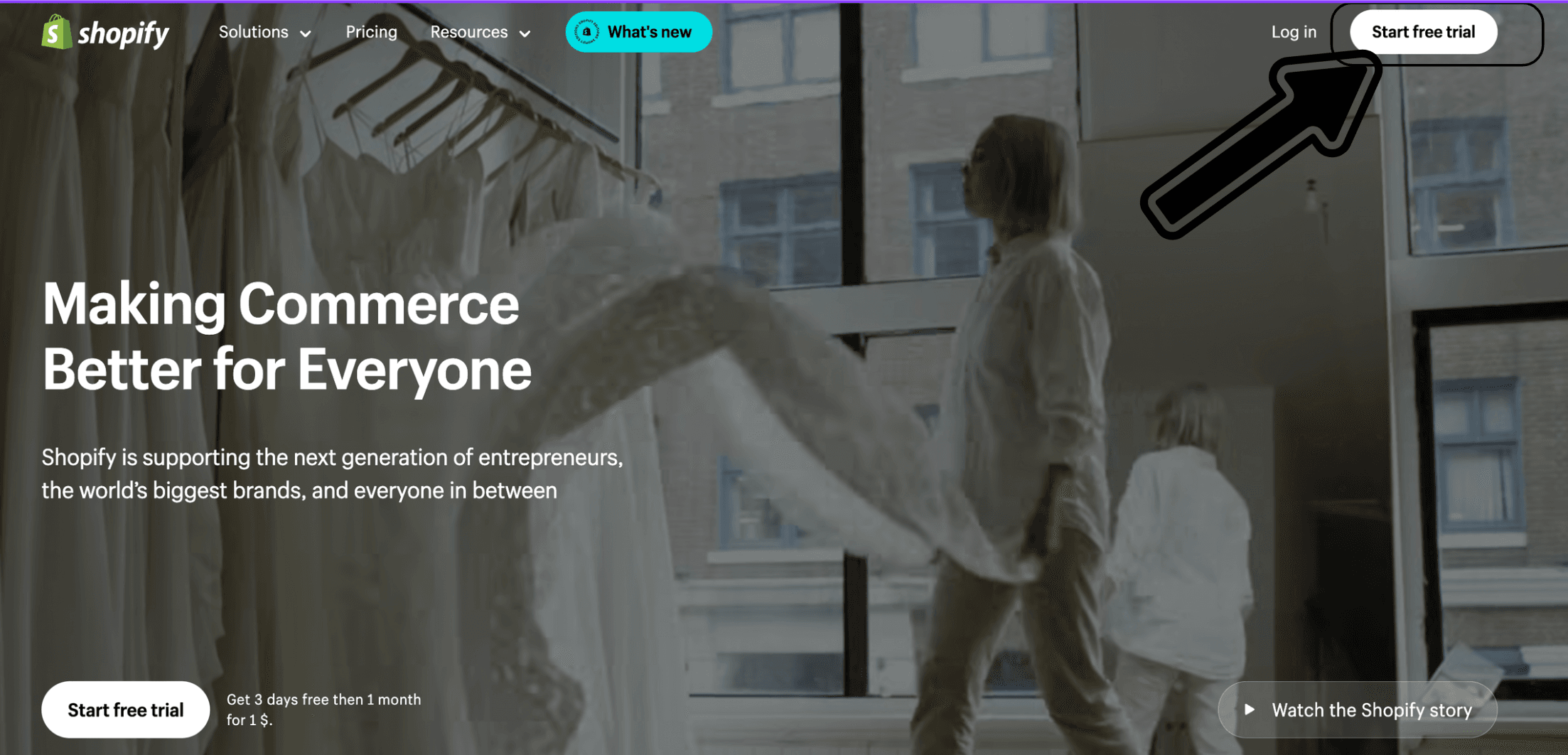

Step 2: Log in to your Shopify Admin

Access your Shopify admin panel by logging into your account.

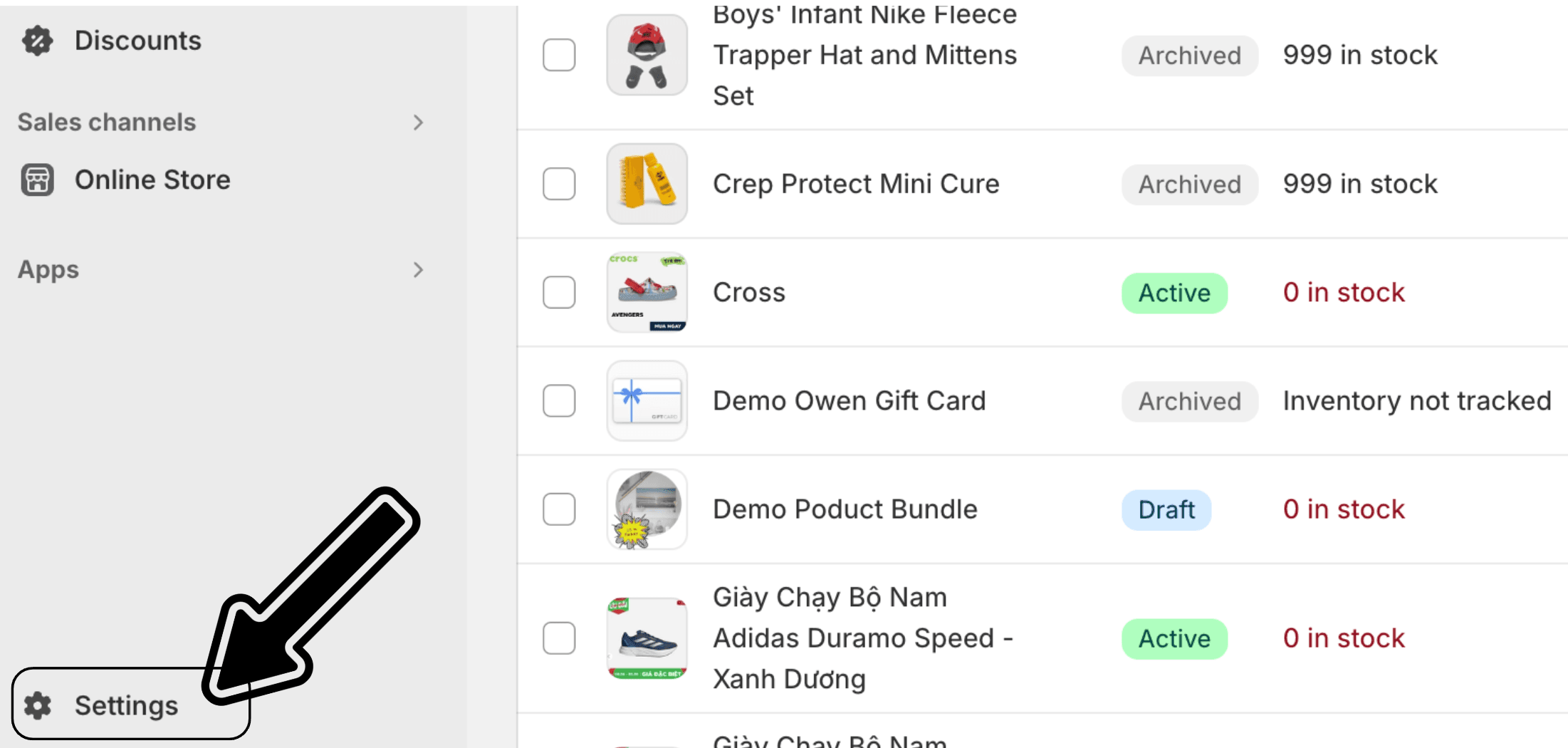

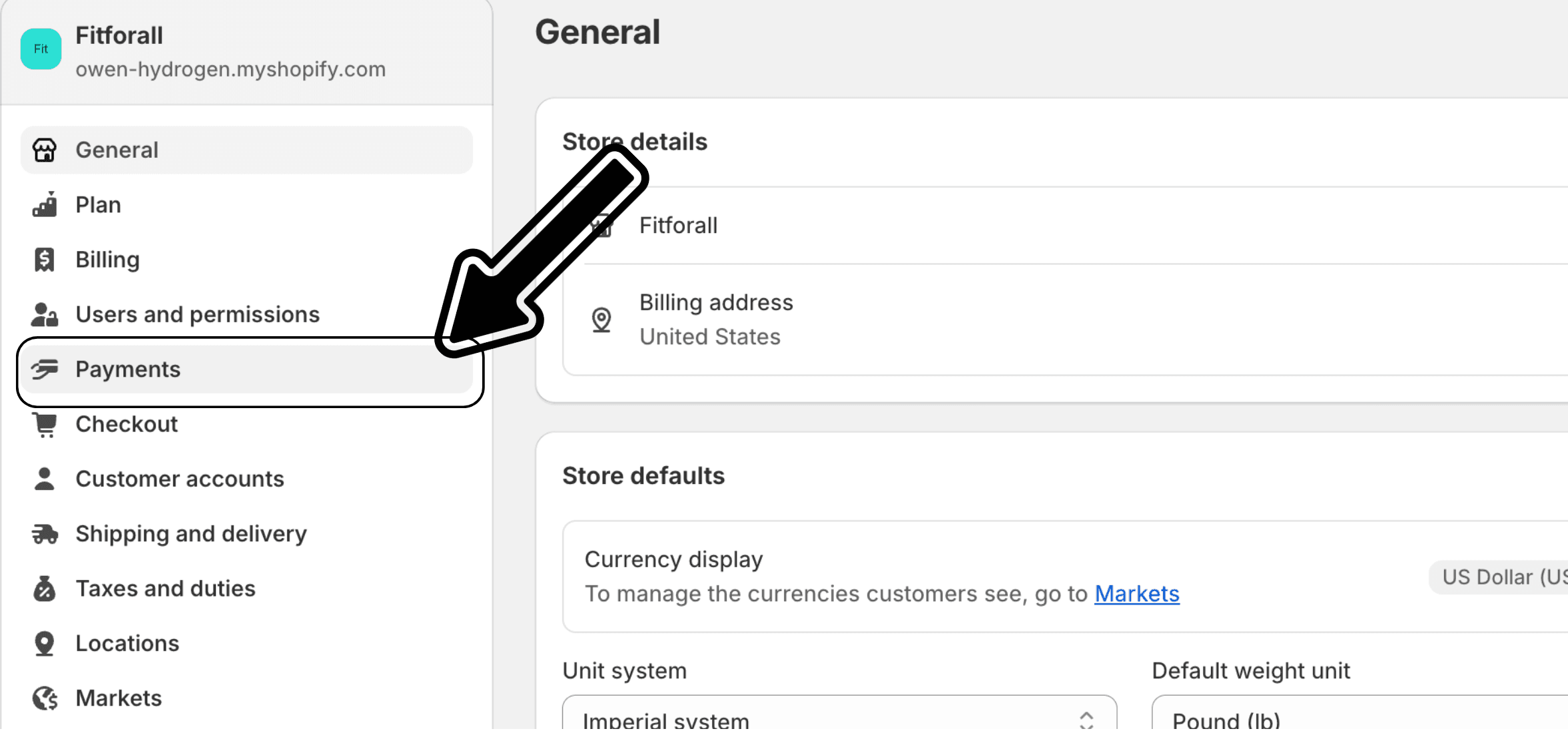

Step 3: Navigate to Payment Providers

In your Shopify admin, go to “Settings” and Then click on “Payments”.

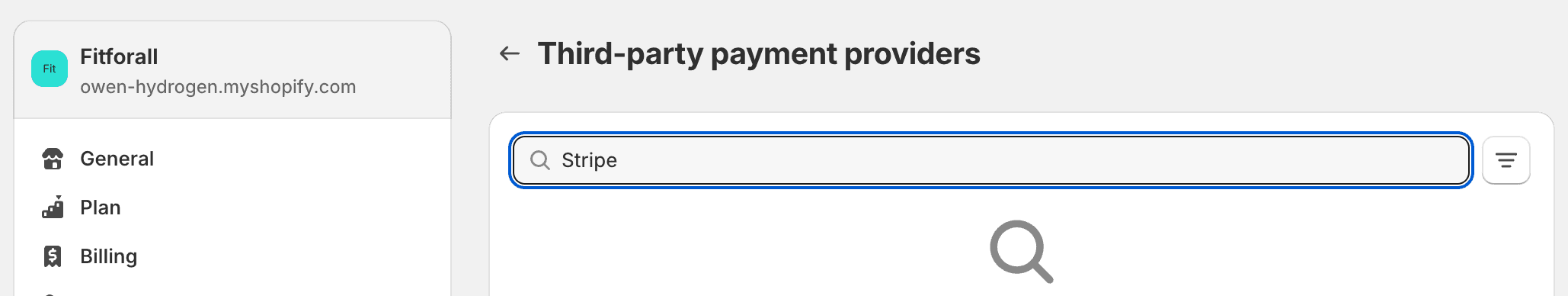

Step 4: Select Stripe as your Payment Provider

Under the Payment Providers section, click on "Add a provider" . Select Stripe from the list of available payment providers.

Step 5: Connect your Stripe Account

You will be prompted to log in to your Stripe account to authorize the connection with Shopify. Follow the on-screen instructions to complete the setup.

Step 6: Configure Payment settings

Once Stripe is connected, you can configure your payment settings. This includes setting up transaction fees, customizing the checkout experience, and enabling additional payment methods supported by Stripe.

IV. Shopify Payments vs Stripe comparison: Pricing and Transaction fees

Shopify Payments and Stripe are both popular payment processing options, but they differ in pricing, features, and how they integrate with e-commerce platforms.

Check out the quick comparison table to help you decide:

Let's break down for a deep look at the different on pricing and transaction fees between Shopify vs. Stripe.

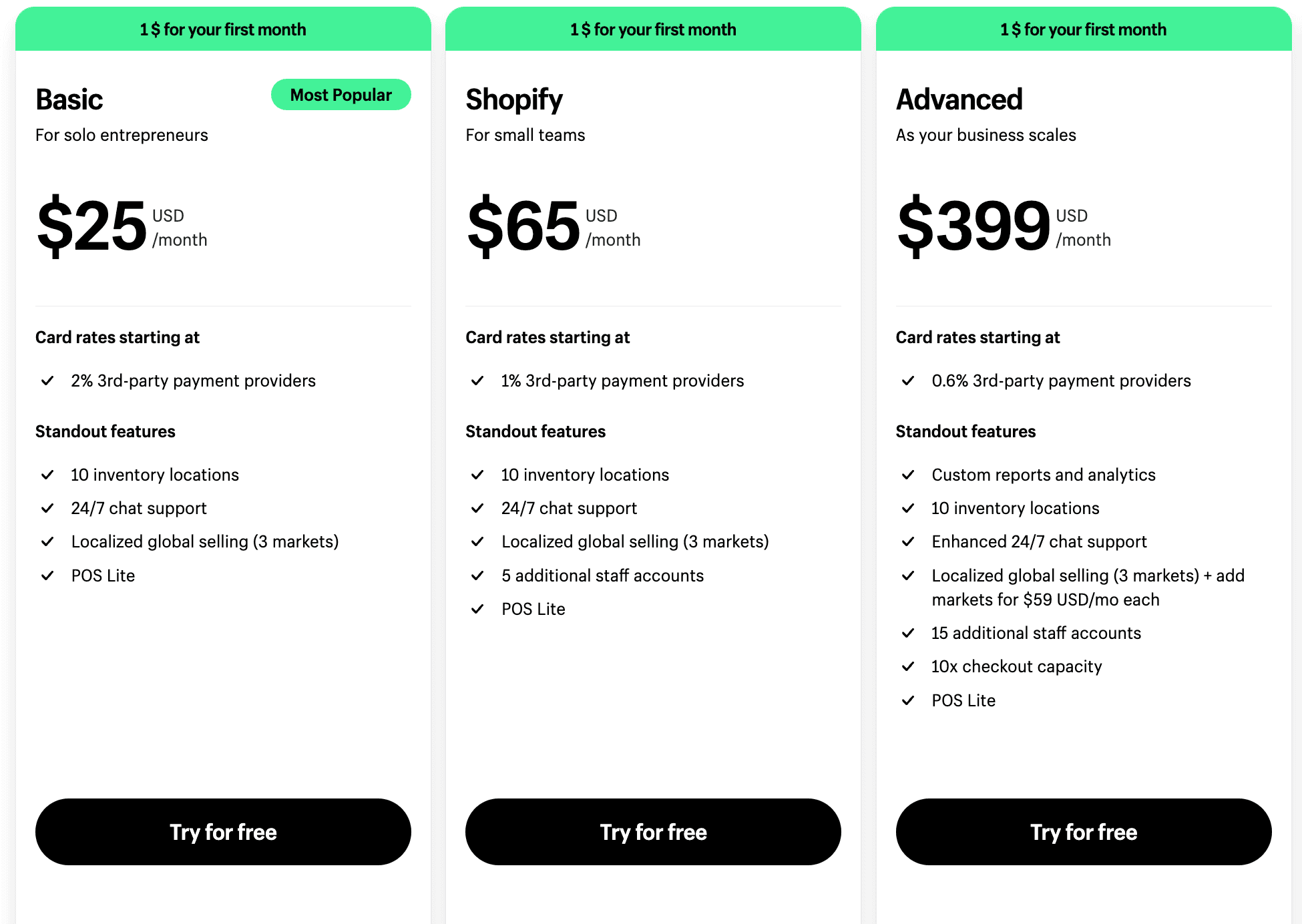

Shopify Payments

Pricing and Fees:

-

Basic plan: $25 per month

-

Shopify plan: $65 per month

-

Advanced plan: $399 per month

Monthly Fee will be included with all Shopify plans.

Transaction Fees:

-

Basic plan: 2.9% + 30¢ per transaction.

-

Shopify plan: 2.6% + 30¢ per transaction.

-

Advanced plan:** 2.4% + 30¢ per transaction.

If you use Shopify Payments, you avoid the additional transaction fees that Shopify charges for using third-party payment gateways (0.5% to 2% depending on your plan).

For your information: The details of Shopify POS Pricing

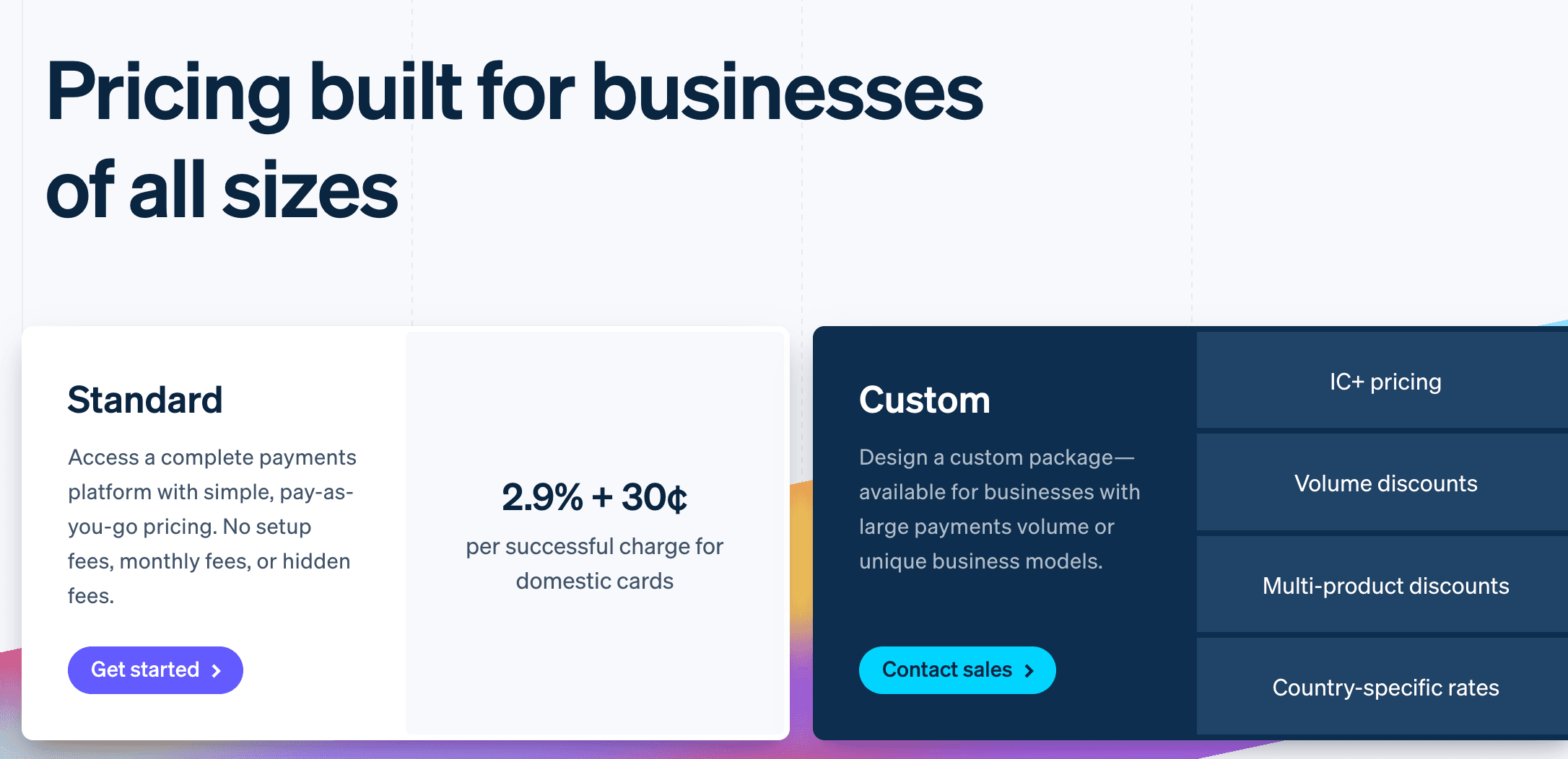

Stripe Payment

Pricing and Fees:

-

Monthly fee: None

-

Transaction fees: 2.9% + 30¢ per transaction

-

International card payments: Additional 1% fee

-

Currency Conversion: Additional 1% fee if applicable

Which one is better for your Shopify?

Choose Stripe if you need a highly customizable payment solution that works with multiple e-commerce platforms or if you require advanced features like subscription billing or marketplace payments. Stripe is perfect for businesses with technical resources and a need for greater flexibility.

Choose Shopify Payments if you are using Shopify and want a seamless, integrated payment solution with no additional transaction fees. It's ideal for small to medium-sized businesses looking for simplicity and ease of use.

For most Shopify users, Shopify Payments is the more convenient and cost-effective choice. However, if you need the advanced capabilities and customization options of Stripe, it may be worth the extra setup and fees.

Final thoughts

Integrating Stripe with Shopify can significantly enhance your store's payment processing capabilities. With its global reach, advanced features, and ease of use, Stripe is an excellent choice for Shopify merchants looking to provide a seamless and secure checkout experience for their customers. By following the steps outlined in this guide, you can quickly set up Stripe as your payment gateway and start enjoying the benefits of this powerful integration.

For more insightful content and guides on optimizing your Shopify store, stay tuned to TrueStorefront.

Frequently Asked Questions

What payment methods does Stripe support?

Stripe supports all major credit and debit cards, as well as digital wallets like Apple Pay, Google Pay, and other local payment methods.

Is Stripe secure?

Yes, Stripe is PCI DSS Level 1 compliant and includes advanced fraud detection tools like Stripe Radar to ensure secure transactions and protect your store from fraudulent activities.

How do I customize my checkout experience with Stripe?

Stripe provides comprehensive APIs and webhooks that allow for custom integrations, enabling you to create a tailored checkout experience that aligns with your brand.

Is Stripe suitable for small businesses?

Yes, Stripe is suitable for businesses of all sizes, from small startups to large enterprises. Its scalable infrastructure can handle millions of transactions, ensuring reliability as your business grows.

Read more: