In the rapidly evolving landscape of e-commerce, staying ahead means constantly adapting to consumer preferences and technological advancements. One such innovation that has reshaped the online shopping experience is Buy Now, Pay Later (BNPL). Among the leading players in this space, Klarna stands out, offering flexible payment solutions that empower shoppers and, in turn, significantly boost conversions for merchants. When integrated with a robust e-commerce platform like Shopify, Klarna creates a powerful synergy that can redefine your sales strategy.

This comprehensive guide will delve deep into the world of Klarna and Shopify, exploring how this integration works, its myriad benefits, and practical steps to leverage it for maximum impact on your online store.

I. Understanding the Buy Now, Pay Later Phenomenon

Before we dive into the specifics of Klarna and Shopify, let's first grasp the fundamental appeal of BNPL. At its core, BNPL allows customers to purchase products immediately and pay for them in installments over a period, often interest-free if payments are made on time. This model addresses several pain points in traditional online shopping:

- Affordability: It makes higher-priced items more accessible by breaking down the cost into manageable chunks.

- Budgeting: Consumers can better manage their finances without having to pay the full amount upfront.

- Flexibility: It offers an alternative to credit cards, often with simpler approval processes.

- Psychological Comfort: The ability to try before fully committing or to spread out payments reduces purchase anxiety.

The rise of BNPL has been meteoric, driven by a new generation of consumers who prefer transparent, flexible, and digital-first payment options. For merchants, this isn't just about offering another payment method; it's about fundamentally enhancing the customer experience, removing barriers to purchase, and ultimately, driving sales.

Klarna: A Closer Look at the BNPL Powerhouse

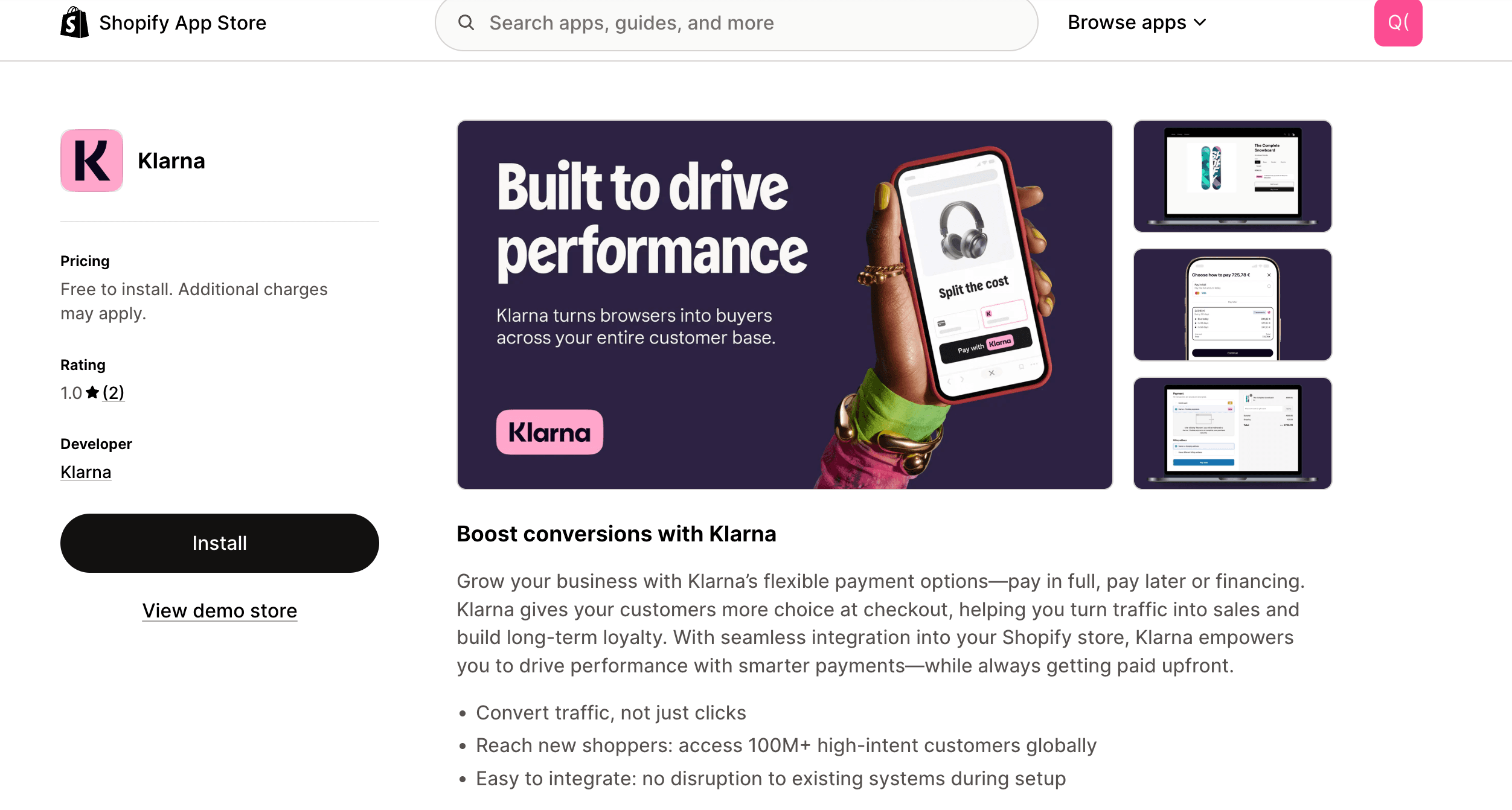

Klarna, a Swedish fintech company founded in 2005, has grown into one of the largest and most recognized BNPL providers globally. Operating in numerous countries, Klarna has cultivated a reputation for its seamless user experience, diverse payment options, and strong focus on consumer convenience.

Klarna offers several popular payment options, each designed to cater to different customer needs:

- Pay in 4 (or Pay in X): This is perhaps Klarna's most well-known offering. Customers can split their purchase into four interest-free payments, typically made every two weeks. This option is ideal for smaller to medium-sized purchases.

- Pay in 30 Days: This allows customers to receive their order and pay for it up to 30 days later. It's perfect for those who want to try items before committing or need a little extra time before their next payday.

- Monthly Financing: For larger purchases, Klarna offers longer-term financing options with interest, allowing customers to spread costs over several months. This acts as a more flexible alternative to traditional credit.

Beyond just payment processing, Klarna also provides a comprehensive shopping app that enhances the entire consumer journey, offering personalized recommendations, deal discovery, and a centralized place to manage all purchases and payments. This holistic approach makes Klarna more than just a payment gateway; it's a shopping partner.

II. The Power Couple: Klarna and Shopify Integration

Shopify, a leading e-commerce platform, empowers millions of businesses worldwide to create and manage their online stores. Its extensive app ecosystem and user-friendly interface make it a popular choice for merchants of all sizes. Integrating Klarna with Shopify brings together the best of both worlds: Shopify's robust e-commerce capabilities and Klarna's flexible payment solutions.

The integration is designed to be straightforward for merchants, allowing them to offer Klarna's payment options directly at checkout. When a customer selects Klarna, they are guided through a quick and secure approval process, often requiring minimal information for instant decisions.

How the Integration Works:

- Activation: Merchants enable Klarna through their Shopify admin panel or by installing the Klarna app from the Shopify App Store.

- Display: Klarna's payment options are displayed prominently on product pages, cart pages, and at checkout. This often includes dynamic messaging that shows customers how little their payments could be (e.g., "4 interest-free payments of $XX.XX").

- Checkout: During checkout, customers select Klarna as their payment method.

- Quick Approval: They provide a few pieces of information (e.g., email, phone number, date of birth) for an instant credit decision by Klarna.

- Order Confirmation: Once approved, the order is confirmed, and the merchant receives the full payment upfront from Klarna, minus Klarna's fees. Klarna then manages the installment collection directly with the customer.

This seamless flow ensures a frictionless experience for the customer while mitigating risk for the merchant, as they are paid in full regardless of whether the customer defaults on their payments to Klarna.

III. The Unmistakable Benefits: How Klarna Boosts Conversions

Now, let's get to the core of the matter: how does integrating Klarna with Shopify directly translate into higher conversion rates and increased sales? The impact is multi-faceted and significant.

1. Increased Average Order Value (AOV)

One of the most immediate and tangible benefits is the uplift in AOV. When customers can spread the cost of a purchase over several payments, they are more inclined to:

- Purchase higher-priced items: A $500 item feels less daunting when broken into four payments of $125.

- Add more items to their cart: Instead of choosing between two desired products, they might buy both, knowing they don't have to pay for everything at once.

- Upgrade to premium versions: The slight price difference for an upgraded model becomes negligible when financed.

This psychological shift from "can I afford this total amount?" to "can I afford these smaller payments?" is a powerful driver for increased spending.

2. Reduced Cart Abandonment

Cart abandonment is the bane of every e-commerce merchant's existence. High shipping costs, complex checkout processes, and a lack of preferred payment options are common culprits. Klarna directly addresses the latter by:

- Offering payment flexibility: Many customers abandon carts because they're not ready or able to pay the full amount upfront. Klarna removes this hurdle.

- Providing a trusted payment alternative: For those wary of credit cards or who prefer not to use them for certain purchases, Klarna offers a secure and familiar option.

- Simplifying the decision-making process: By making the purchase more affordable, it reduces the likelihood of customers second-guessing their decision at the last minute.

Studies consistently show that offering BNPL options can drastically reduce cart abandonment rates, turning would-be lost sales into successful conversions.

3. Enhanced Customer Experience and Loyalty

A smooth and flexible checkout experience is crucial for customer satisfaction. Klarna contributes significantly to this by:

- Frictionless Process: The quick approval and clear payment schedule make the purchase process enjoyable.

- Empowerment: Giving customers control over how and when they pay fosters a sense of trust and appreciation.

- Repeat Business: Happy customers are loyal customers. Merchants who offer Klarna often see higher rates of repeat purchases, as customers know they can rely on convenient payment options.

- Broader Customer Base: BNPL solutions appeal to a wider demographic, including younger shoppers who may not have credit cards or prefer not to use them, and budget-conscious consumers looking for smarter ways to manage their spending.

4. Improved Conversion Rates

Ultimately, all the aforementioned benefits converge to drive higher conversion rates. By removing financial barriers, reducing purchase anxiety, and enhancing the overall shopping experience, Klarna makes it easier for customers to complete their purchases. This is not just about converting more visitors into buyers; it's about converting more of the right visitors into higher-value buyers.

Merchants frequently report significant boosts in conversion rates after implementing Klarna, sometimes seeing increases of 20% or even higher, depending on their product category and target audience.

5. Competitive Advantage

In a crowded e-commerce market, any edge you can gain over competitors is invaluable. Offering Klarna positions your brand as modern, customer-centric, and attuned to the latest consumer payment trends. If your competitors aren't offering flexible payment options, you gain a distinct advantage that can attract and retain customers.

IV. Real-World Impact: Statistics and Case Studies

The claims about Klarna's impact are not just theoretical. Numerous studies and merchant success stories corroborate its effectiveness:

- Klarna's Own Data: Klarna reports that merchants using its services often see a 20-45% increase in average order value and a 30% increase in conversion rates.

- Industry Trends: A recent study by Adobe Analytics found that BNPL usage surged by 42% year-over-year during the holiday season, indicating a strong consumer preference for these options.

- Merchant Testimonials: Businesses across various sectors, from fashion and electronics to home goods, consistently praise Klarna for its role in boosting sales and improving customer satisfaction. Many report that customers explicitly seek out Klarna as a payment option.

These figures underscore that integrating Klarna is not just a nice-to-have but a strategic imperative for modern e-commerce businesses looking to maximize their potential on Shopify.

V. How to Enable Klarna on Shopify: A Step-by-Step Guide

You can successfully connect Klarna Payments to your Shopify store by following this step-by-step installation guide. The process ensures your store settings meet Klarna requirements, customer information is properly collected, and the payment flow works smoothly at checkout.

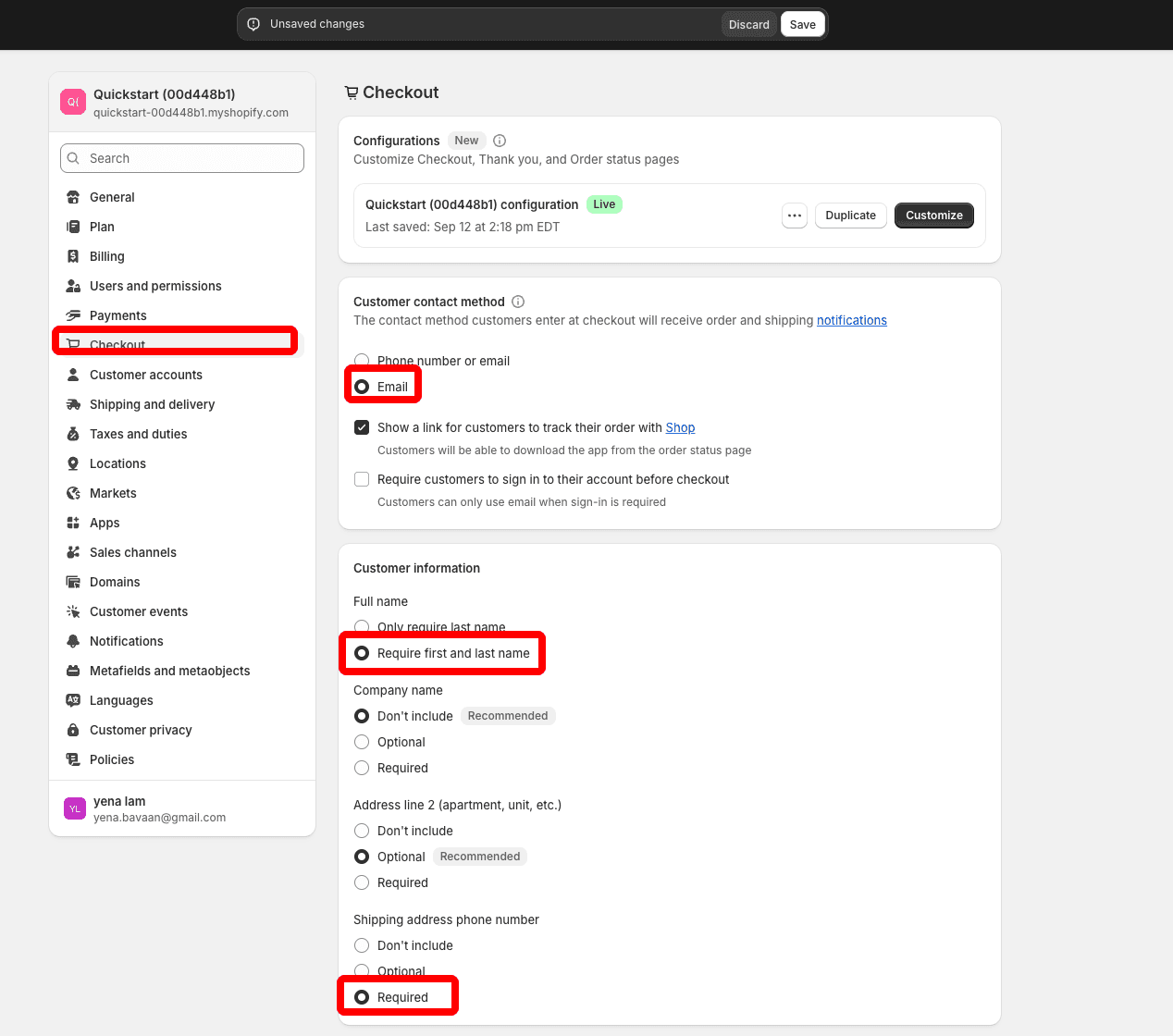

Step 1: Verify Shopify Checkout Settings and Log In

Before integrating Klarna, ensure your Shopify checkout settings are configured correctly.

In your Shopify admin dashboard:

- Go to Settings > Checkout

- Under Customer Contact Method, select Email only If the customer’s email is not shared with Klarna, the payment will fail and the customer will be redirected to checkout to re-enter their email.

- Under Customer Information, set Full name to Require first and last name

- Under Shipping address phone number, select Required

These settings are mandatory for Klarna to process transactions successfully.

Once confirmed, log in to:

- Shopify Admin (as the full account owner)

- Klarna Merchant Portal

Step 2: Open Shopify Integration in Klarna Merchant Portal

In the Klarna Merchant Portal:

- Select Integration Guides from the left-hand navigation

- Choose Shopify from the list of available platforms

If you do not see the Integration Guides option, contact Klarna Merchant Support to enable access.

Step 3: Start the Installation

To begin the setup:

- Click Continue to initiate the integration process

- Select Install Klarna Shopify Application

Although this is a public app, it will not appear in the Shopify App Store or your Apps list. This behavior is normal for Shopify payment applications.

Step 4: Install Klarna in Shopify

You will be redirected to your Shopify admin panel:

- Click Install on the first authorization screen

- Click Install again on the confirmation page

This completes the app installation and links Klarna to your Shopify store.

Step 5: Generate Credentials and Verify Integration

Next, you must generate Klarna API credentials:

- Click Generate and connect credentials

- Download the API credentials to your local device Although you will not use them manually, downloading is required to proceed

- Click Continue integration

- Select Verify integration to confirm that the setup is correct

This step ensures Shopify and Klarna are properly connected.

Step 6: Activate Klarna Payments

After verification:

- Click Next to reach the activation page

- Click Next again to return to Shopify

- Activate Klarna as a payment method in your Shopify checkout

Once activated, Klarna becomes available at checkout. This step does not automatically validate the integration, so manual testing is recommended.

Step 7: Confirm Klarna Appears at Checkout

Klarna Payments are now live on your Shopify store.

To confirm everything works correctly:

- Add a product to your cart

- Proceed to checkout

- Check that Klarna appears as a payment option

- Click Pay Now or Complete to ensure the Klarna payment flow launches correctly

Placing a test order is optional but recommended for full verification.

Explore more: Installing Klarna Payments for Shopify

VI. Optimizing Your Klarna Strategy on Shopify

Simply enabling Klarna is a great start, but to truly maximize its impact, consider these optimization tips:

Simply enabling Klarna is a great start, but to truly maximize its impact, consider these optimization tips:

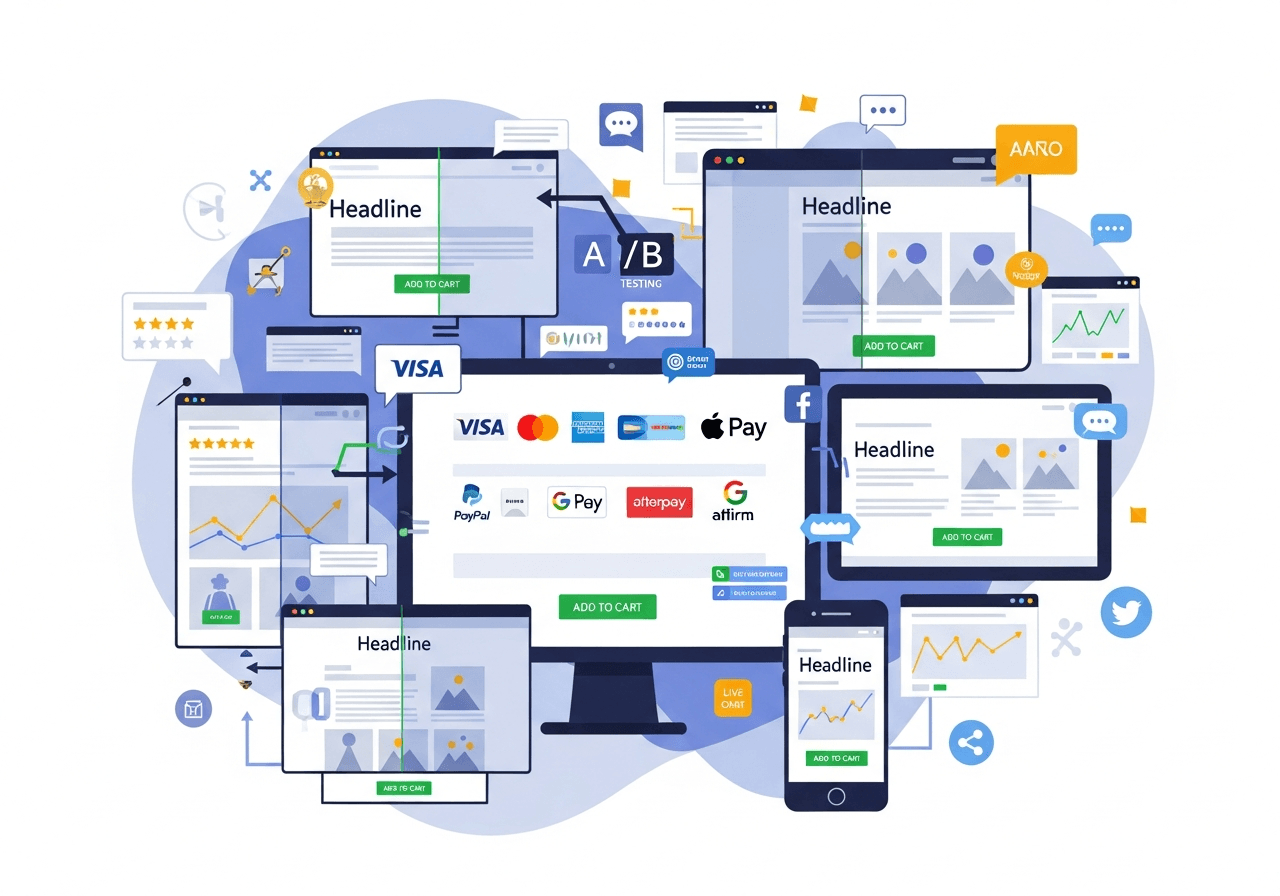

- Prominent On-Site Messaging: Use the Klarna On-Site Messaging app to its fullest. Display dynamic messaging on product pages (e.g., "or 4 interest-free payments of $X.XX"), collection pages, and even your cart summary. The more visible Klarna is, the more likely customers are to consider it.

- A/B Test Messaging: Experiment with different wording and placement of Klarna's messaging to see what resonates best with your audience.

- Educate Your Customers: Consider adding a dedicated FAQ page or a small section in your footer explaining how Klarna works, addressing common questions about payments, eligibility, and returns. This builds trust and reduces potential customer service inquiries.

- Leverage Klarna's Brand: Klarna is a well-recognized and trusted brand. Don't hesitate to use their official logos and branding elements to signal security and convenience to your customers.

- Integrate with Marketing Efforts: Include Klarna as a payment option in your marketing campaigns, especially for promotions of higher-priced items. "Get it now, pay later!" can be a powerful call to action.

- Monitor Performance: Regularly review your Shopify analytics to track the impact of Klarna on your AOV, conversion rates, and cart abandonment. Use this data to refine your strategy.

- Consider Bundling: If you sell complementary products, consider creating bundles that, when combined, might push the total price higher. With Klarna, customers are more likely to opt for the bundle, increasing your AOV.

- Retargeting with BNPL Focus: For customers who abandoned their cart, consider retargeting ads that specifically highlight the availability of Klarna's flexible payment options as a solution to their potential purchase hesitation.

VII. Addressing Common Concerns

While Klarna offers significant advantages, merchants sometimes have questions or concerns.

- Fees: Klarna charges merchants a fee per transaction, similar to other payment processors. These fees vary based on the Klarna product, region, and merchant agreement. It's crucial to understand these costs and factor them into your pricing strategy. However, the increase in AOV and conversion often far outweighs these fees.

- Returns: Returns processed through Shopify will automatically trigger a refund process with Klarna. Klarna handles the communication with the customer regarding their payment plan adjustments or refunds. The merchant's process for returns remains largely unchanged.

- Credit Checks: For options like Pay in 4 or Pay in 30 Days, Klarna typically performs a soft credit check that does not impact the customer's credit score. For longer-term financing, a hard credit check may be performed. The key is that Klarna manages this, not the merchant.

- Fraud: Klarna has sophisticated fraud detection systems in place, and because they pay the merchant upfront, the fraud risk is largely shifted from the merchant to Klarna.

By understanding these aspects, merchants can confidently integrate and leverage Klarna without undue worry.

VIII. The Future of Payments: Why BNPL is Here to Stay

The shift towards flexible payment solutions like Klarna is not a fleeting trend but a fundamental evolution in consumer behavior and payment technology. Several factors suggest BNPL will continue to grow in prominence:

- Demographic Shift: Younger generations, often skeptical of traditional credit models, are embracing BNPL for its transparency and ease of use.

- Economic Pressures: In an unpredictable economic climate, consumers appreciate tools that help them manage their budgets and cash flow more effectively.

- Technological Advancements: The seamless integration capabilities and instant approval processes offered by BNPL providers make them increasingly attractive.

- Competition: As more players enter the BNPL market, innovation will continue to drive better solutions and greater adoption.

For Shopify merchants, aligning with this future means embracing platforms like Klarna to not only meet current customer expectations but also to stay relevant and competitive in the long run.

Conclusion: Embrace the Power of Klarna and Shopify

In the competitive world of e-commerce, every tool that can enhance the customer experience and drive sales is invaluable. The integration of Klarna with Shopify offers a compelling solution that addresses both these critical aspects. By providing flexible, transparent, and convenient payment options, Klarna empowers your customers, reduces purchase friction, and demonstrably boosts your conversion rates and average order value.

From increasing customer loyalty to attracting new demographics and gaining a significant competitive edge, the benefits of "Buy Now, Pay Later" with Klarna on Shopify are clear. Don't let your business be left behind in the evolving payment landscape.

Enable Klarna on Shopify today and watch your conversions soar. It's not just a payment method; it's a strategic growth driver for your online store.